hpo economic commentary, 2nd quarter 2020

The COVID-19 decline is severe, but the long-term forecasts by hpo remain unchanged

Share article

The long-term real economic cycles show a negative development

In July 2019, Peter Meier and Josua Burkart of hpo forecasting were quoted in a double interview in the Technische Rundschau as follows: “Our model clearly indicates a deep and prolonged decline. We are heading for a recession.” But we had not expected the recession to hit so quickly and severely.

The measures to contain COVID-19 led to a brutal fall in consumption. The data situation for the first quarter is still patchy. But in France, for example, retail sales in March collapsed by over 17 % in a single month. The situation is similar in other countries. The decline is historically unique and, for once, this expression is not worn thin.

What happens next? With the loosening of the shutdown measures in Europe and the USA effective from May, consumption will certainly rise again. But it is not likely to return to pre-crisis levels in the foreseeable future. In China, which is about two months ahead of Europe in the COVID-19 crisis, retail sales in April are still 7.5 % below the previous year’s figures. Considering the fact that this value also includes the generally very solid sales of daily consumer goods and that China continues to show much stronger trend growth than the OECD countries, this value is still very low.

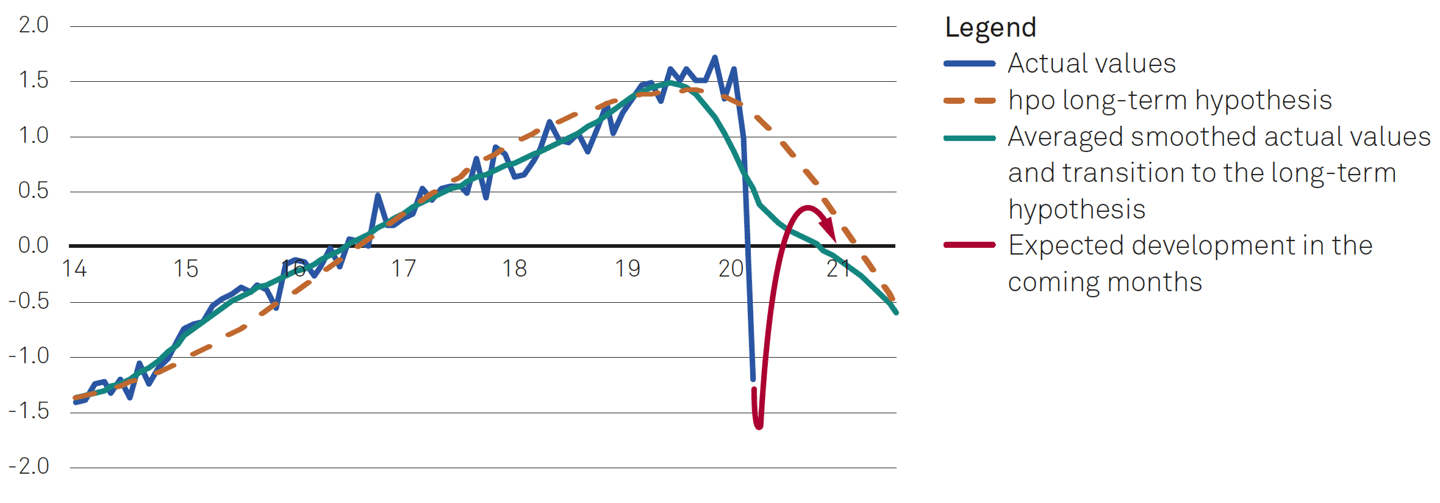

Deviation from the long-term trend growth of EU retail trade turnover

The middle- and long-term outlook is not changed by the short-term distortions around COVID-19. Here, the long-term real economic cycles remain the dominant influencing factors. These continue to show a pessimistic development for most sectors.

The graph on the left shows our hypothesis for retail trade turnover in the EU. The X-axis refers to the annual figures and the Y-axis to the standardized deviation from long-term trend growth. We expect retail sales to grow strongly again in the coming months, but only roughly to the level of the green line, which refers to the smoothed actual values and the transition to the dashed long-term hypothesis. In other words, we expect a partial short-term recovery in retail sales (catch-up effects of the shutdown). After that, however, consumption will slowly decline again.

The PMI is currently sending out a deceptive signal

In the current phase the picture is most likely too positive.

This means that for the capital goods industry, which in many cases suffered a sharp slump as early as 2019 and is already further along the cycle, the low point will now be reached earlier than expected. Consumer-related sectors, in particular, may experience a partial recovery in the short-term before the values fall again. Incoming orders in other industries will probably remain at a low level for some time.

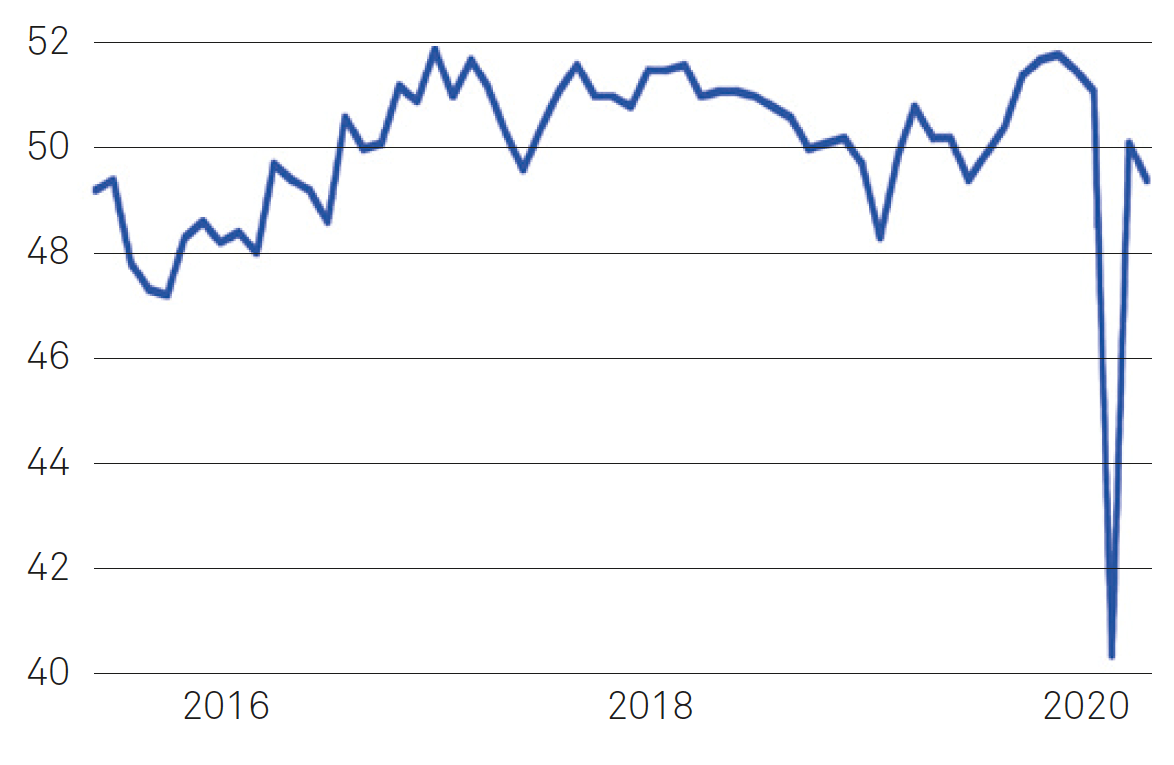

Is the Chinese PMI the harbinger of recovery?

A much-noticed sentiment indicator for China is the Manufacturing Purchasing Managers Index (PMI) compiled by Caixin and IHS Markit. After an extreme drop in February, it recovered strongly in March and April and is now only slightly below pre-crisis levels. This circumstance is partly interpreted as an indication that the pre-crisis level will be reached again soon. This also seems to be the dominant opinion in the financial markets, considering the recent price rally

China Caixin Manufacturing PMI (Ilustration Trading Economics)

However, this interpretation should be treated with caution as the Neue Zürcher Zeitung (NZZ) aptly described in an article entitled “Industry PMIs show only half the truth” published on 2 April 2020. The Purchasing Managers’ Index surveys the chief buyers of hundreds of companies every month about performance and prices in comparison to the previous month. If these buyers are now being surveyed in an extremely poor month in which the economy is practically coming to a standstill – as was the case in China in February 2020 – and it is foreseeable that the lockdown measures will be somewhat eased, it is obvious that the buyers’ assessment of next month will be somewhat more positive than the current one. The starting position in China in February 2020 was extremely low due to the forced shutdown, and the situation could practically only get better. The consequence of this is that the PMI is mistakenly showing a strong recovery, even though the following month will presumably still be very weak in terms of business. In fairly steady times, the PMI is a very good indicator of the short-term development in the industrial sector. In the current phase, however, the picture is most likely too positive.

Overall, the database on the economic COVID-19 fault lines is still very thin and incomplete. A more precise, data-based assessment of what is currently happening to the economy will only be possible with the next quarterly update in mid-August.