hpo economic commentary, 1st quarter 2023

How robust is the economy in 2023?

“Not as bad as feared!” These were the words used by European Central Bank President Christine Lagarde to describe the mood of the economic elite at this year’s World Economic Forum in Davos. While in fall many economic institutes and banks revised their economic forecasts for 2023 downward, in some cases sharply, confidence has been growing again since December that the world is facing only a slight dip in growth. For example, in its World Economic Outlook at the end of January the International Monetary Fund raised its forecast for global GDP growth in the new year from 2.7% to 2.9%. This view is also shared by the financial markets, which got off to a flying start in the new year.

The reasons for the improved mood among the business elite in Davos are the following developments:

- A surprisingly robust real economy with unemployment rates remaining very low

- Falling infation rates in the United States and Europe

- China’s surprise end to strict Corona measures at the end of 2022

Share article

Key economic data remain robust

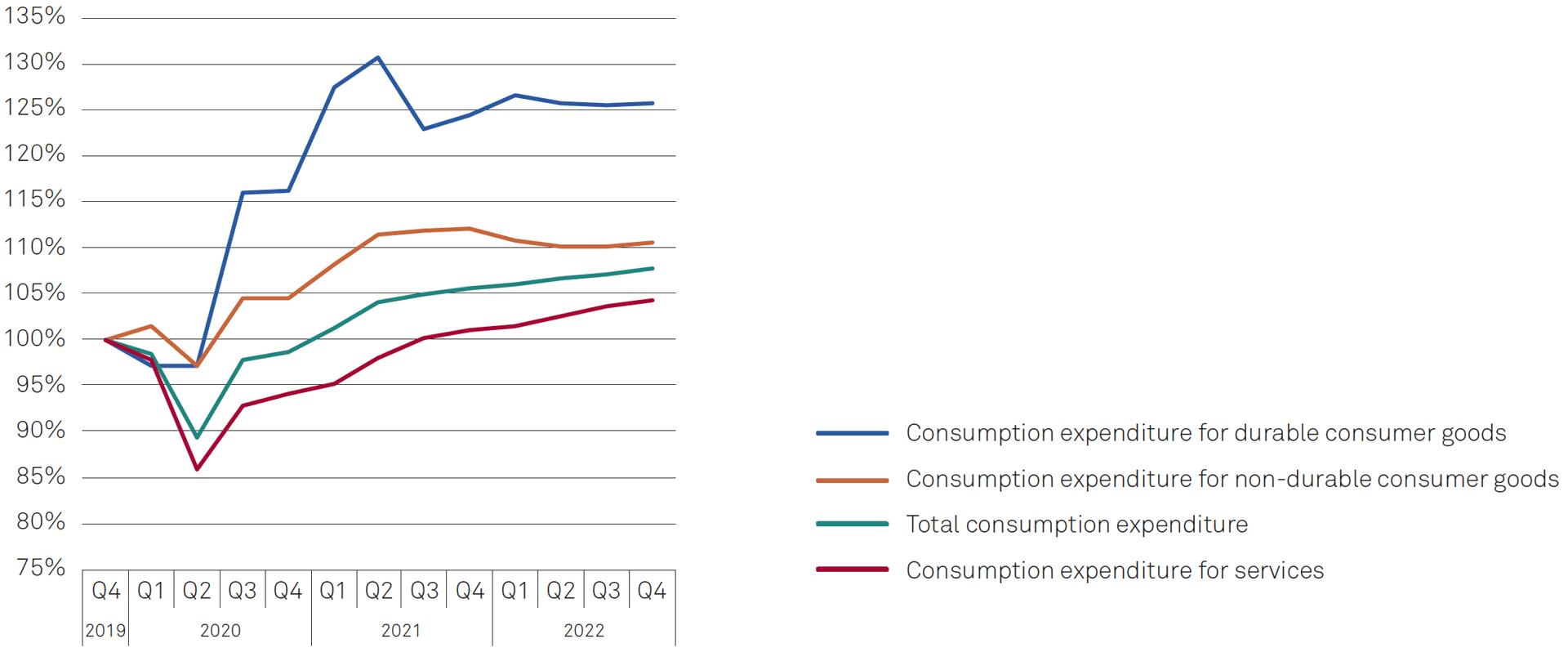

The retail sector in the United States and Europe has been quite stable in recent months. Consumption of consumer durables in the United States, for example, remains extremely high. U.S. consumers still spent 26% more on consumer durables in Q4 2022, adjusted for inflation, than in the last pre-pandemic quarter at the end of 2019. In Europe, where stimulus packages to the population were distributed more cautiously during the pandemic, the corresponding figure is again just below the level of Q4 2019.

Development of the inflation-adjusted consumption pattern in the United States since the outbreak of the pandemic

Source: raw data by Bureau of Economic Analysis (BEA), illustration by hpo forecasting

However, it would be very surprising if this overconsumption simply continued. In the meantime, it is no longer financed with government checks, but increasingly also with consumer credit, which has been rising rapidly in the United States since mid-2021 and whose level is constantly reaching new record levels.

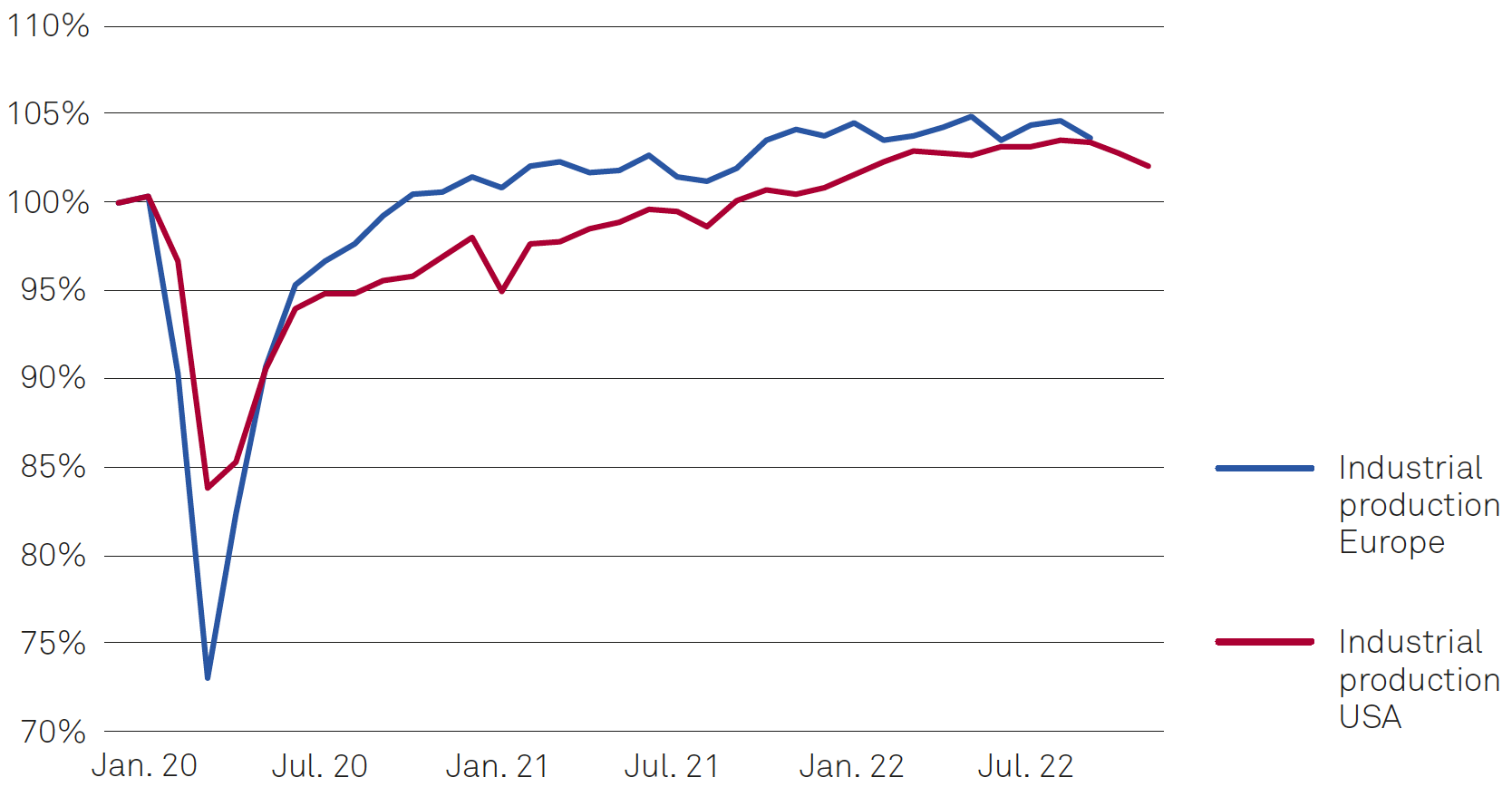

Industrial production also developed very stably for a long time and grew relatively steadily in both the United States and Europe. While in Europe the 2019 level was exceeded already by the end of 2020, the United States only reached the pre-crisis level towards the end of 2021. Since October, however, industrial production has been falling in both regions.According to hpo model calculations, this weakening momentum in industry will continue in the coming months.

Development of industrial production in Europe and the United States

Source: raw data by OECD; illustration by hpo forecasting

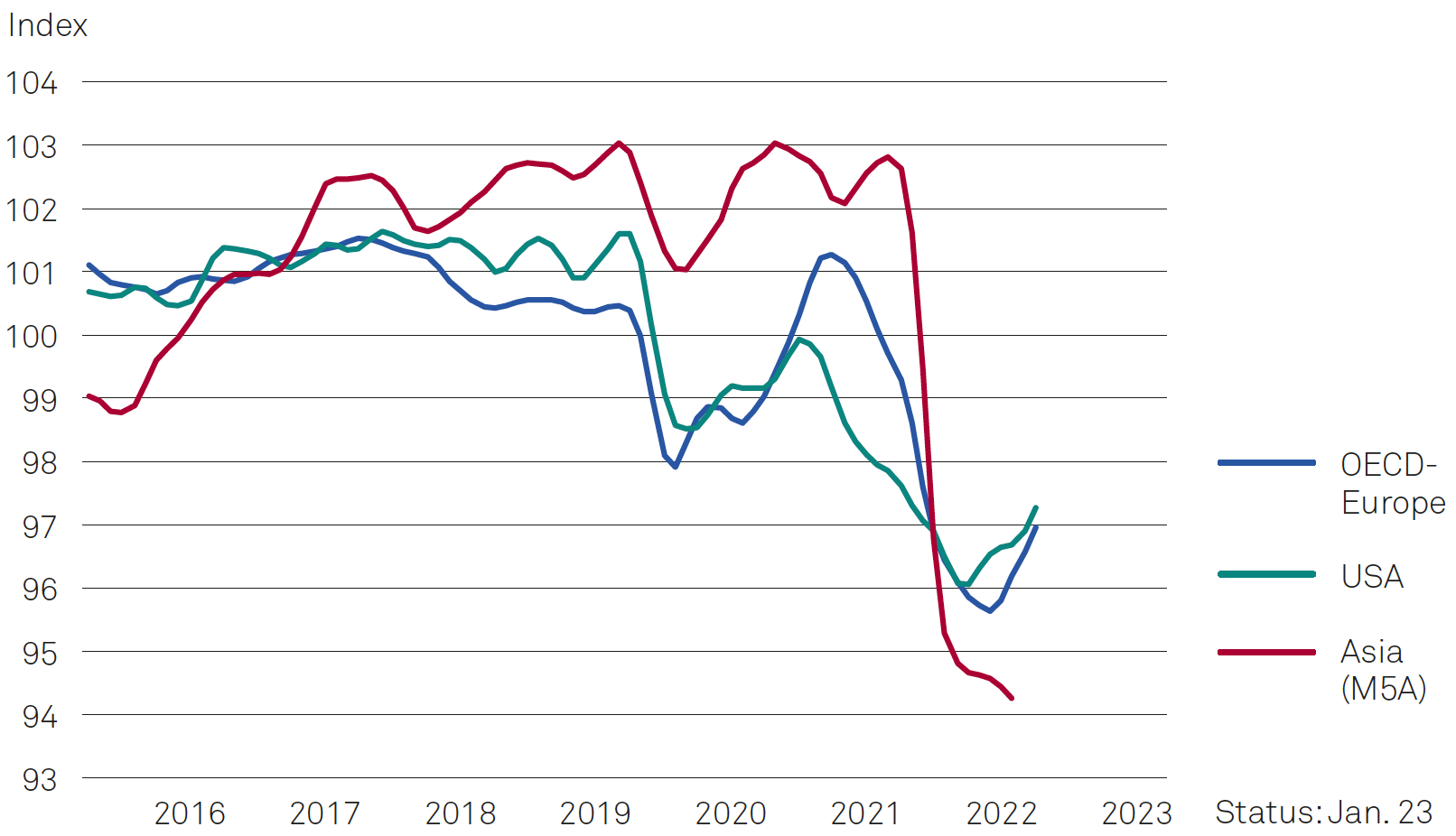

While retail and industrial production had a strong supportive effect on the real economy last year, consumer sentiment in Europe, Asia and the United States has been falling rapidly since 2021 and reached historic lows in all three regions by mid-2022. In the last quarter, the trend reversed slightly, and sentiment brightened somewhat. Historically, consumer sentiment remains extremely pessimistic and the index is far below the neutral value of 100.

Development of the Consumer Confidence Index in Europe, the United States and Asia (M5A); values below 100 = pessimistic consumer sentiment

Source: raw data by OECD, illustration by hpo forecasting

The mood among companies looks better. Relieved that inflation appears to have peaked and that the worst fears of an energy crisis in the winter did not materialise, the Business Confidence Index (BCI) for Europe published by the OECD stabilised in the fourth quarter and is now back just into expansionary territory. Data from the ifo Institute for Germany show that expectations for the future in particular have improved sharply in recent months. In the United States, by contrast, the BCI continued to fall unabated in Q4 and at 99 points is in contractionary territory.

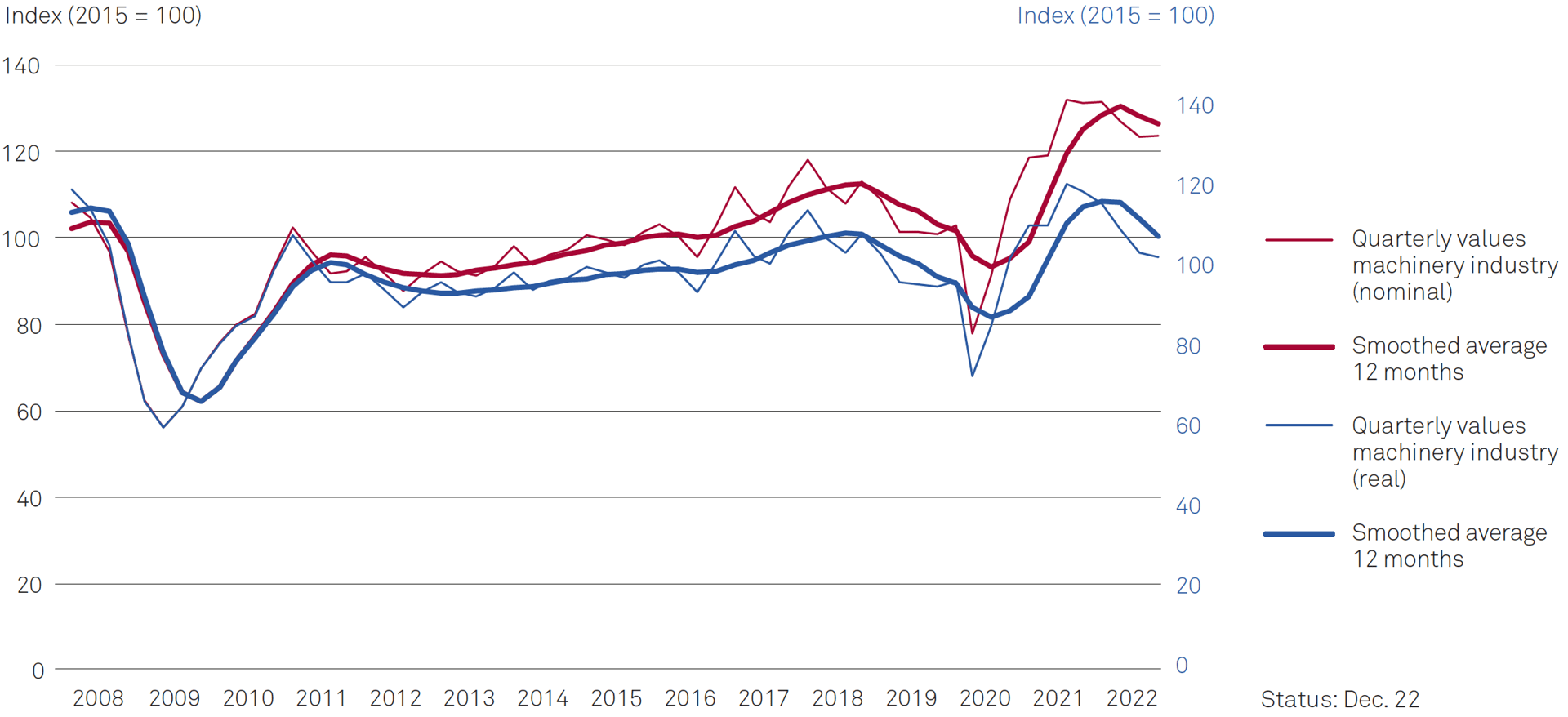

Demand for machines decreases

As expected, the slowdown in order intake in the mechanical engineering sector continued. According to the German statistics office Destatis, order intake by German mechanical engineering companies in the fourth quarter fell by 6% year-on-year in nominal terms and by as much as 14% when adjusted for inflation. The German Engineering Federation (VDMA) even reported a real decline of 18% in incoming orders of its member companies for the same period.

Destatis also reports falling order intake figures for the late-cyclical German machine tool industry for the fourth quarter: –2% year-on-year in nominal terms and –14% in real terms.

Order intake German mechanical engineering – real and nominal

Source: raw data by Destatis, illustration by hpo forecasting

U.S. corporate demand for machinery from around the world fell 1% year-over-year in nominal terms in Q4, which also represents a real year-over-year decline of more than 10%.

Demand for semiconductors and equipment investment for semiconductor fabs decouple

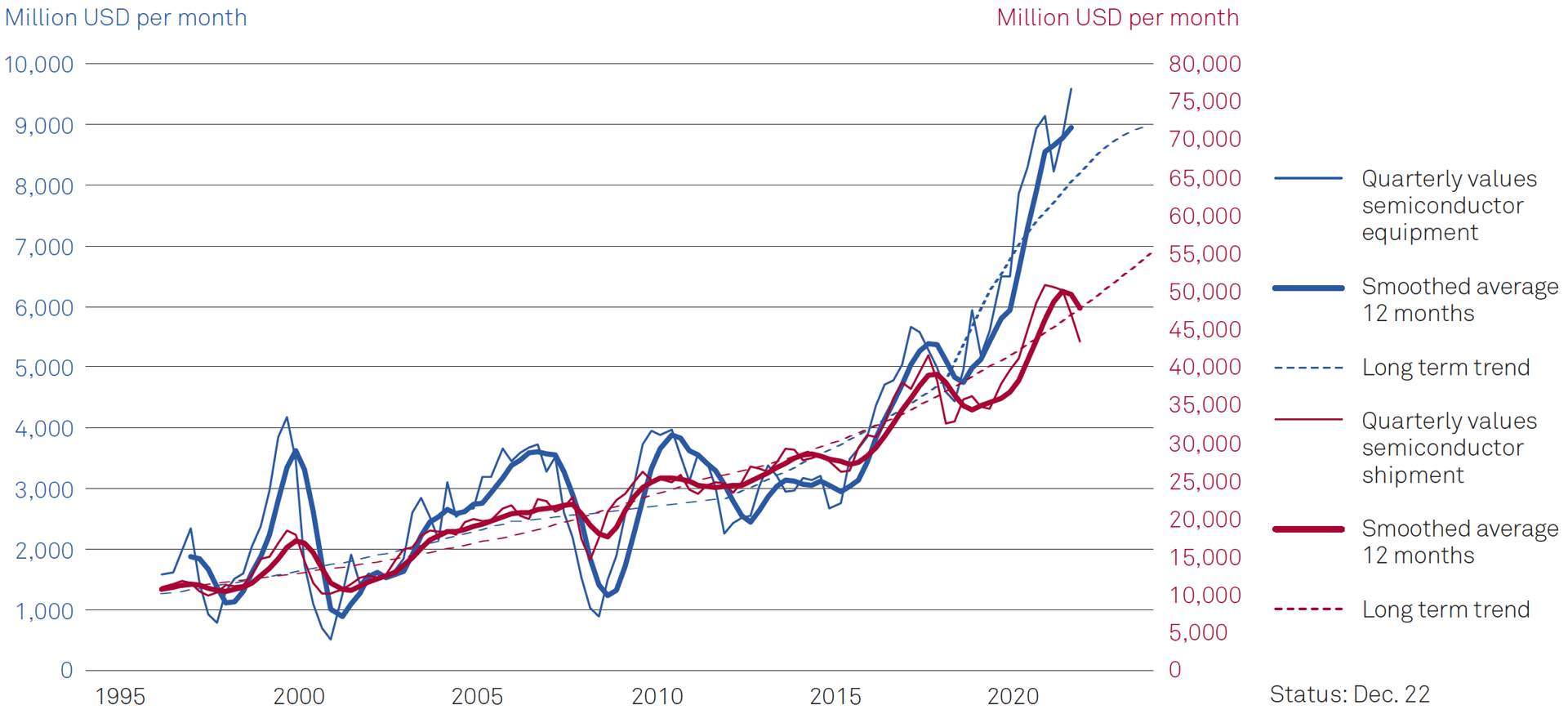

The disrupted supply chains have been one of the dominant topics in the business press for the last two years. Stimulus measures by governments and changes in consumer habits among the population also led to an acute shortage of semiconductors. There was much speculation as to whether the rapidly advancing digitalisation and the increasingly widespread use of computer chips would cause the traditionally pronounced cyclicality of this industry to disappear. The figures of recent months show that this is not the case.

According to the industry association SEMI, global semiconductor shipments fell by 15% year-on-year in the last quarter. Demand for PCs and cell phones in particular has really collapsed in recent months. The data service provider Gartner calculated that worldwide sales of notebooks and desktop computers fell 29% in the fourth quarter. Sales of the American chip producer Intel fell 14% in the fourth quarter, and the company expects a continued sharp decline in the current quarter. Most recently, SEMI also sharply revised down its forecast for the new year, and the association now shares hpo’s long-standing estimate that semiconductor demand will weaken temporarily in 2023.

As the dominant economic powers have granted large subsidies for the semiconductor industry, the expansion of semiconductor production capacities continues to grow regardless of this. According to a list from Semiconductor Engineering, between 2022 and 2025 investments of between USD 300 and 460 billion have been announced worldwide, which corresponds to annual investments of around USD 100 billion. According to the study, investments in this key industry will remain at a very high level for several years.

The long-term trend growth of the semiconductor industry and semiconductor equipment suppliers has thus decoupled. Production capacities are increasing rapidly, and it can be assumed that this will lead to overcapacities in the market.

Semiconductor shipment billings vs. semiconductor equipment billings

Sources: raw data by SIA, SEMI, SEJA, illustration by hpo forecasting

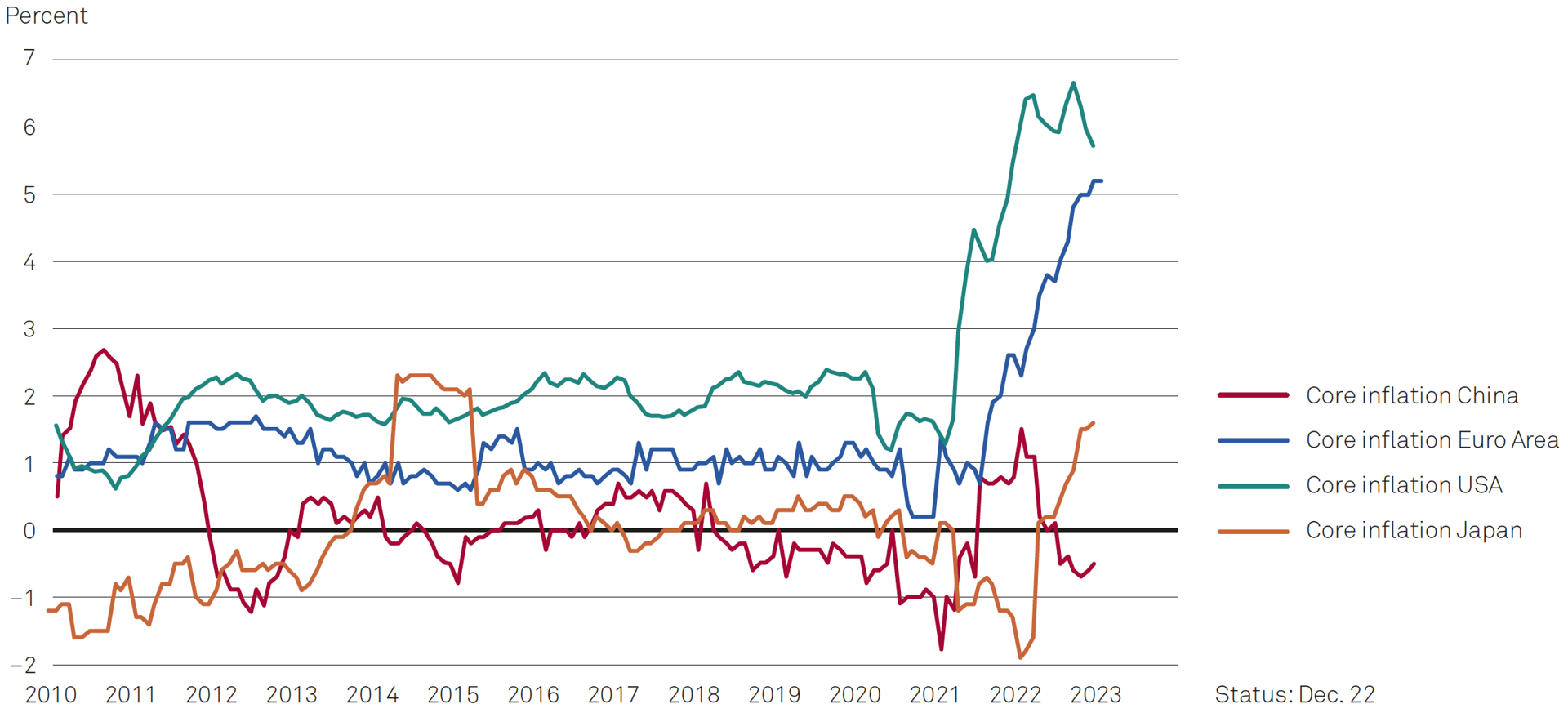

Core inflation remains very high

One important reason for the euphoria on the financial markets at the start of the year is falling inflation rates. In both the United States and the euro zone, the inflation peak was clearly exceeded in the second half of the year. Just as many observers were astonished by the sharp rise in inflation, the rapid decline is now also surprising. However, at 6.4% in America and 8.5% in the euro zone (as of January), the level of inflation remains well above the 2% target. In Japan (4%) and China (1.8%), the inflation rate is significantly lower.

The financial markets now expect the world’s leading central bank – the Fed – to cut key interest rates again as early as the second half of the year. However, these hopes may be premature. Core inflation, which excludes food and energy prices, which are particularly volatile in terms of price, remained at a record level in the euro zone in January (5.2%). In the United States, a volatile sideways movement has been discernible for around a year (5.6% in January), and the sharp decline has so far failed to materialise here.

Development of core inflation in different regions

Sources: raw data by Eurostat, BLS, NBS, illustration by hpo forecasting

As long as core inflation remains high and the unemployment rate very low, the risk of a wage-price spiral is not averted. To prevent this, central banks must cool the economy by raising key interest rates. The problem is that the effect of the key rate hike will only be felt in the real economy with a delay of several quarters. Therefore, there is a great danger that the national banks will overdrive or, on the other hand, that they won’t fight inflation decisively enough.

Both could have serious consequences. If interest rates are raised too much, the economy will be stalled, threatening recession and possibly a debt crisis. If, on the other hand, interest rates are raised too little, the goal of price stability will be missed, higher inflation expectations will take root in people’s minds and interest rates will have to be raised all the more sharply later on in order to restore the credibility of the central banks. This scenario would markedly increase the risk of recession. In the current cycle of interest rate hikes, the central banks in Europe and the United States are walking a delicate tightrope, the outcome of which is by no means clear.

China’s opening will support the global economy

The overdue end of China’s tough covid measures at the end of 2022 will provide bright spots in the new year. The International Monetary Fund raised its 2023 GDP forecast for China to 5.2% at the end of January and estimated that China will be responsible for around 20% of global economic growth this year.

As in the West, the Chinese also accumulated a lot of savings during the pandemic. According to calculations by the The Economist magazine, Chinese households have about USD 720 billion in extra savings because the savings rate shot up from 30% to 33% of disposable income during the pandemic. If all of that extra money were consumed this year, consumption would nominally skyrocket by 14%. Overall, Chinese households have bank balances of USD 18 trillion, or just under USD 13,000 per person, according to the U.S. bank Citigroup.

The lifting of Corona measures in China should not obscure the fact that important structural problems will remain. Shang-Jin Wei, former chief economist of the Asian Development Bank and economics professor at Columbia University, identifies the following three main challenges for the Chinese economy.

Short-term challenge: In recent years, the Chinese government has gambled away a great deal of trust among the population and in the economy with very short-term and sometimes extreme changes in regulations, laws, financing conditions and state interventions. China must become more predictable again. As long as consumers and investors are uncertain, they will remain reluctant to consume and invest. This crisis of confidence is currently acute in the struggling real estate sector, which is eminently important for China’s national economy. Digital platform companies and the tutoring market have also been hit hard by regulations.

Medium-term challenge: In order to maintain the high growth rates of recent decades, productivity growth in the Chinese economy must increase markedly. This will require far-reaching, market-oriented reforms, for example to abolish the privileges of state-owned enterprises and to counteract the misallocation of capital to expensive infrastructure projects.

Long-term challenge: In January, China reported a shrinking population for the first time. However, the issue has been acute for some time, as according to Shang-Jin Wie, the Chinese working-age population has been shrinking for about 10 years. However, there are still large segments of the population living in rural areas who are poorly educated and whose domestic mobility is restricted by strict residence controls. There is still a lot of potential here to cushion the negative effects of the demographic turnaround.

Conclusion

In summary, the following points can be made:

- The global real economy continues to develop robustly and has so far been more resilient than many observers expected.

- Nevertheless, demand for capital goods has weakened markedly in recent months and this trend will continue in the coming months according to hpo model calculations.

- Core inflation is still very high and the effect of the increases in key interest rates to date on the real economy cannot be fully assessed until around mid-year.

- China’s opening up is a valuable support for the global economy in the new year, but major structural problems remain, above all the loss of confidence in the Chinese government and the smoldering real estate crisis.